Interactive Publication

Create an interactive PDF Flipbook

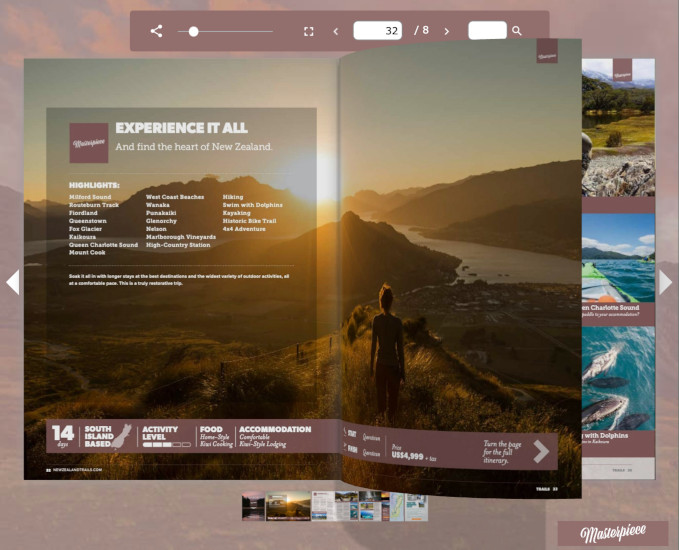

Use FlowPaper to convert your PDFs to interactive 3D flipbooks

NOTE: This publication is pending deletion. The account which was used to upload this publication needs to be renewed in order for this publication to stay online.

FlowPaper provides a publisher that can be used to convert PDFs into a range of different publications. A few different publications can be seen below.

Use FlowPaper to convert your PDFs to interactive 3D flipbooks